Financial Considerations when Planning to Leave

If you are in immediate danger, call 9-1-1. If you are ready to leave, there are a few things you may be able to do to help with financial safety planning. Your safety comes first, so don't worry about these things if you can't do them safely.

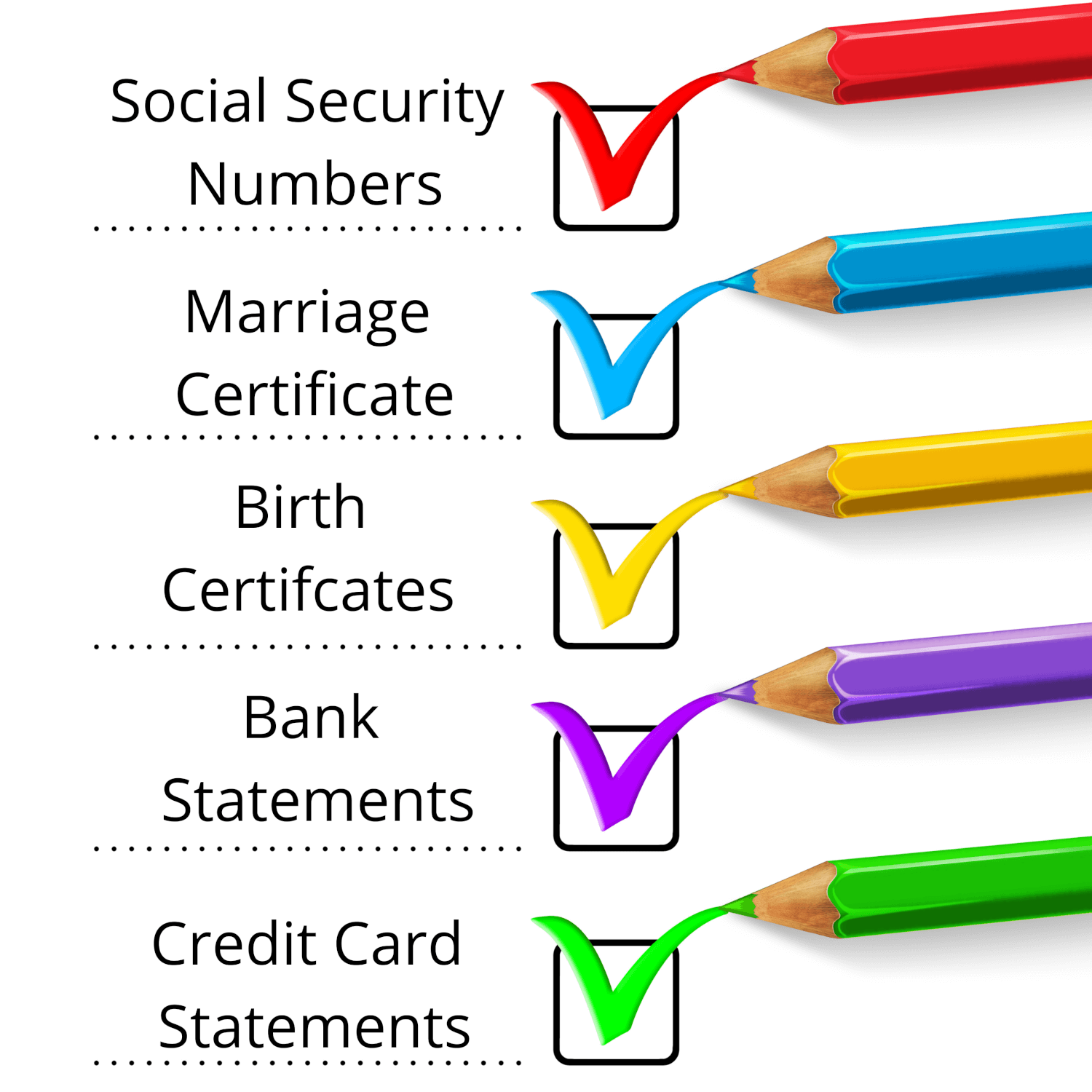

Documents you may want to have (or have copies of):

- Social Security Numbers (for yourself, children, and your partner)

- Copies of marriage and birth certificates

- Copies of bank and credit card statements

- Copies of any benefits (public assistance, retirement) or insurance coverage (auto, life, etc.)

from the Allstate Foundation and National Network to End Domestic Violence Moving Ahead Curriculum